This article was orignally featured in Bitcoin Optech Newsletter #48, and has been excerpted, abbridged, and updated slightly for accuracy with the most recent iteration of the BIP for this page. The original OpTech content may be found here. OpTech’s content is offered under the MIT License.

The proposed opcode OP_CHECKTEMPLATEVERIFY allows an address to commit to one or more branches that require the

transaction spending them to include a certain set of outputs, a

technique that contract protocol researchers call a covenant.

The primary described benefit of this proposed opcode is allowing a

small transaction to be confirmed now (when fees might be high) and have that transaction

trustlessly guarantee that a set of people will receive their actual

payments later when fees might be lower. This can make it much more

economical for organizations that already implement techniques such as

payment batching to handle sudden fee spikes.

Before we look at the new opcode itself, let’s take a moment to look at how you might accomplish something similar using current Bitcoin transaction features.

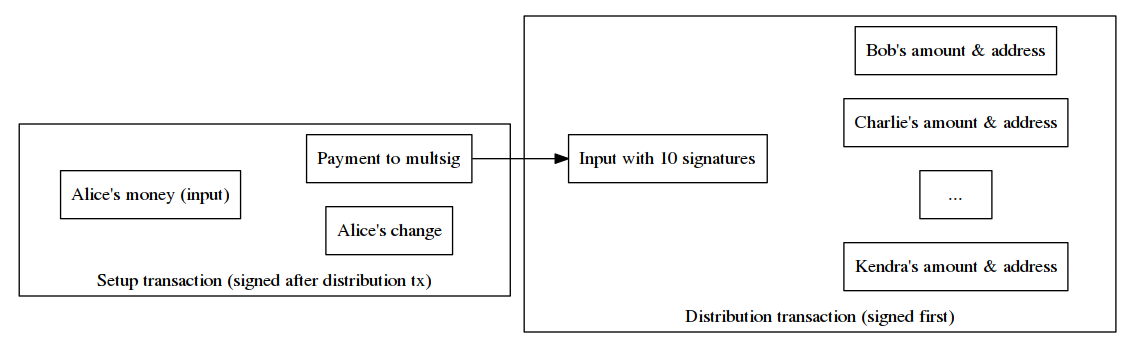

Alice wants to pay a set of ten people but transaction fees are currently high so that she doesn’t want to send ten separate transactions or even use payment batching to send one transaction that includes an output for each of the receivers. Instead, she wants to trustlessly commit to paying them in the future without having to pay onchain fees for ten outputs now. So Alice asks each of the receivers for one of their public keys and creates an unsigned and unbroadcast setup transaction that pays those keys using a 10-of-10 multisig script. Then she creates a child transaction that spends from the multisig output to the 10 outputs she originally wanted to create. We’ll call this child transaction the distribution transaction. She asks all the receivers to sign this distribution transaction and she ensures each person receives everyone else’s signatures, then she signs and broadcasts the setup transaction.

When the setup transaction receives a reasonable number of confirmations, there’s no way for Alice to take back her payment to the 10 receivers. As long as each of the receivers has a copy of the distribution transaction and all the others’ signatures, there’s also no way for any receivers to cheat any other receiver out of a payment. So even though the distribution transaction that actually pays the receivers hasn’t been broadcast or confirmed, the payments are secured by the confirmed setup transaction. At any time, any of the receivers who wants to spend their money can broadcast the distribution transaction and wait for it to confirm.

This technique allows spenders and receivers to lock in a set of payments during high fees and then only distribute the actual payments when fees are lower. According to Bitcoin Core fee estimates at the time of writing, anyone patient enough to wait a week for a transaction to confirm (like the distribution transaction above) can save significantly on fees. Let’s look at the example above in that context. To make later comparisons to Taproot more fair, we’ll assume some form of key and signature aggregation is being used, such as [MuSig][] or (in theory) multiparty ECDSA (see [Newsletter #18][]).

| Individual Payments | Batched Payment | Commit now, distribute later | |

|---|---|---|---|

| Immediate (high fee) transactions | 10x141 vbytes | 1x420 vbytes | 1x141 vbytes |

| Cost at 0.00142112 BTC/KvB | 0.00204641 | 0.00059687 | 0.00020037 |

| Delayed (low fee) transactions | — | — | 1x389 vbytes |

| Cost at 0.00001014 BTC/KvB | — | — | 0.00000394 |

| Total vbytes | 1,410 | 420 | 530 |

| Total cost | 0.00204641 | 0.00059687 | 0.00020431 |

| Savings compared to previous column | — | 71% | 66% |

We see that this type of trustlessly delayed payment can save 66% over payment batching and 90% over sending separate payments. Note that the savings could be even larger during periods of greater fee stratification or with more than ten receivers.

OP_CHECKTEMPLATEVERIFY

The proposed soft fork would add a new opcode, OP_CHECKTEMPLATEVERIFY (abbreviated by

its author as OP_STB). This opcode and a hash digest could be included in

tapleaf scripts, allowing it to be one of the conditions in a Taproot address.

When that address was spent, if OP_STB was executed, the spending transaction

would only be valid if the hash digest of its outputs matched the hash digest

read from the script by OP_STB.

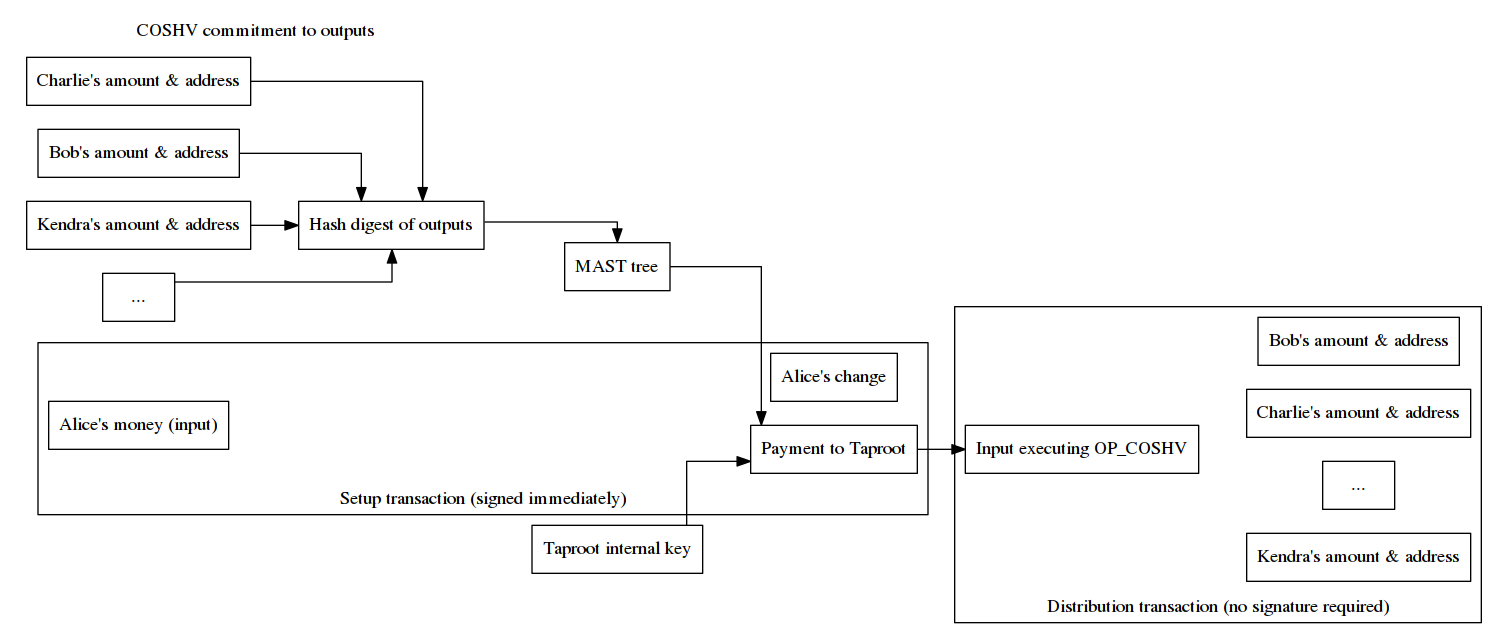

Comparing this to our example above, Alice would again ask each of the participants for a public key (such as a Taproot address[^taproot-pubkeys]). Similar to before, she’d create 10 outputs which each paid one of the receivers—but she wouldn’t need to form this into a specific distribution transaction. Instead, she’d just hash the ten outputs together and use the resultant digest to create a tapleaf script containing OP_STB. That would be the only tapleaf in this Taproot commitment. Alice could also use the participants’ public keys to form the taproot internal key to allow them to cooperatively spend the money without revealing the Taproot script path.

Alice would then give each of the receivers a copy of all ten outputs to allow each of them to verify that Alice’s setup transaction, when suitably confirmed, guaranteed them payment. When they later wanted to spend that payment, any of them could then create a distribution transaction containing the committed outputs. Unlike the example from the previous subsection, they don’t need to pre-sign anything so they would never need to interact with each other. Even better, the information Alice needs to send them in order to allow them to verify the setup transaction and ultimately spend their money could be sent through existing asynchronous communication methods such as email or a cloud drive. That means the receivers wouldn’t need to be online at the time Alice created and sent her setup transaction.

This elimination of the need to interact is a particular highlight of the proposal. If we imagine the example above with Alice being an exchange, the interactive form of the protocol would require her to keep the ten participants online and connected to her service from the moment each of them submitted their withdrawal request until the interaction was done—and they’d all need to use wallets compatible with such a child transaction signing protocol. The non-interactive form with OP_STB would only require them to submit a Bitcoin address and an email address (or some other protocol address for delivery of the committed outputs).

Feedback and activation

The proposal received over 30 replies on the Bitcoin-Dev mailing list as of this writing. The concerns raised included:

Not flexible enough: Matt Corallo says, “we need to have a flexible solution that provides more features than just this, or we risk adding it only to go through all the effort again when people ask for a better solution.”

Not generic enough: Russell O’Connor suggests both OP_STB and

SIGHASH_ANYPREVOUT(described in last week’s newsletter) could be replaced using anOP_CATopcode and anOP_CHECKSIGFROMSTACKopcode. Both opcodes are currently implemented in ElementsProject.org sidechains such as Liquid . TheOP_CATopcode catenates two strings into one string and theOP_CHECKSIGFROMSTACKopcode compares a signature on the stack to other data on the stack rather than to the transaction that contains the signature. Catenation allows a script to include various parts of a message that are combined with witness elements at spend time in order to form a complete message that can be verified usingOP_CHECKSIGFROMSTACK.Because the message that gets verified can be a Bitcoin transaction—including a partial copy of the transaction the spender is attempting to send—these operations allow a script to evaluate transaction data without having to directly read the transaction being evaluated. Compare this to OP_STB which looks at the hash of the outputs and anyprevout which looks at all the other signatures in the transaction.

A potentially major downside of the cat/checksigfromstack approach is that it requires larger witnesses to hold the larger script and all of its witness elements. O’Connor noted that he doesn’t mind switching to more concise implementations (like OP_STB and anyprevout) once it’s clear a significant number of users are making use of those functions via generic templates.

Not safe enough: Johnson Lau pointed out that OP_STB allows signature replay similar to BIP118 noinput, a perceived risk that BIP AnyPrevout takes pains to eliminate.

Rubin and others provided at least preliminary responses to each of these concerns. We expect discussion will be ongoing, so we’ll report back with any significant developments in future weeks.

The [proposed BIP for OP_STB][bip-coshv] suggests it could be activated along with bip-taproot (if users desire it). As bip-taproot is itself still under discussion, we don’t recommend anyone come to expect dual activation. Future discussion and implementation testing will reveal whether each proposal is mature enough, desirable enough, and enough supported by users to warrant being added to Bitcoin.

Overall, OP_STB appears to provide a simple (but clever) method for allowing outputs to commit to where their funds can ultimately be sent. In next week’s newsletter, we’ll look at some other ways OP_STB could be used to improve efficiency, privacy, or both.